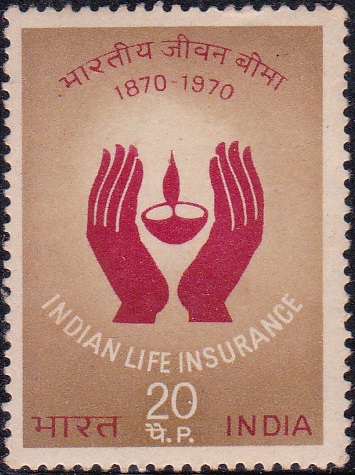

Indian Life Insurance

A commemorative postage stamp on the Centenary of Life Insurance Corporation (LIC), an Indian state-owned insurance group and investment company :

Issued on Jan 11, 1971

Issued for : The Life Insurance Corporation has just celebrated the Centenary of Indian life assurance industry in India and the Posts and Telegraphs Department feels privileged to associate itself with this event by bringing out a commemorative stamp on this occasion.

Description of Design : The design of the stamp is vertical and depicts two hands protecting the flame of life.

Type : Stamp, Mint Condition

Colour : Sepia and Crimson

Denomination : 20 Paise

Overall Size : 3.91 X 2.90 cms.

Printing Size : 3.56 X 2.54 cms.

Perforation : 13 x 13

Watermark : Printed on unwatermarked Adhesive stamp paper

Number Printed : 30,00,000

Number per issue sheet : 35

Printing Process : Photogravure

Designed and Printed : India Security Press

About :

- The story of insurance is probably as old as the story of mankind. However, the concept of ‘life insurance’, as now understood, is largely a development of the last 400 years. The institution of joint families in India had for ages afforded complete protection to all its members and under its all-pervading shade, its members never suffered from any want. With the gradual breaking up of the joint family system, the modern concept of life insurance has been gaining ground progressively.

- Life insurance business in India was in vogue prior to 1870. But its benefits were available mainly to European settlers or limited sectarian groups. Life insurance policies were issued mostly by European companies. In several cases the benefit of life insurance was not available to every one due to restrictions of caste or creed.

- 1870 marked a turning point in the history of life insurance in India. It was in that year that the first truly Indian Life Insurance Company was started, which accepted Indian lives freely for the first time without any restriction or distinction. Since then the story of Indian Life Assurance has been one of steady progress.

- The development of life insurance in the early stages was fostered by a good measure of competition between foreign insurers and the Indian initiative. This rivalry went a long way in enhancing the popularity of life insurance in our country. There were many benefits which were offered to the policy holders as a result of such competition.

- In the wake of the political consciousness that swept the entire sub-continent, insurance business received an added impetus that ultimately resulted in diversification of insurance plans, liberal returns and efficient servicing. Immediately preceding the World War II, legislation that culminated in the Insurance Act of 1938 helped the Indian insurers in maintaining sound and healthy business growth. The Act aimed to protect the interests of the policyholders.

- While, initially, the institution of insurance was used simply to provide a sum of money at death or the expiry of a specified term, gradually it was realised that the mobilisation of savings for the public good was even more vital a factor.

- On January 19, 1955, the Government nationalised life insurance business and the Life Insurance Corporation came into being on September 1, 1956, taking over the liabilities of some 745 private insurers and Provident Fund Societies operating in the country. With a monopoly of life insurance business in the country, the LIC stands guard over the hopes and future of millions of families and has been a great source of general economic strength.

- The Corporation has acquired stature and stability as the largest nationalised life insurance institution in the democratic world. From a business of a little over Rs. 300 crores in 1957, its new business shot up to over Rs. 1000 crores in 1970. The immense magnitude of its operations can be gauged by the fact that the total business in force is now over Rs. 6,425 crores and continues to grow year by year.

- As a matter of interesting coincidence, it may be observed that the actual entry of the State in the sphere of life insurance was contemplated In the year 1870. The death of a Postmaster in harness around that year, leaving his family in indigent circumstances aroused public opinion and prompted a demand for the introduction of Government sponsored scheme of life insurance. The outcome of this demand was the introduction of a scheme of life insurance in 1883 by the Postal Department for its employees which was by stages extended to cover all Government and quasi-Government employees.

[…] is the UTI Mutual Fund, sponsored by State Bank of India, Punjab National Bank, Bank of Baroda and Life Insurance Corporation, with each of them holding 18.5% stake in the paid up capital of UTI AMC. It is registered with […]