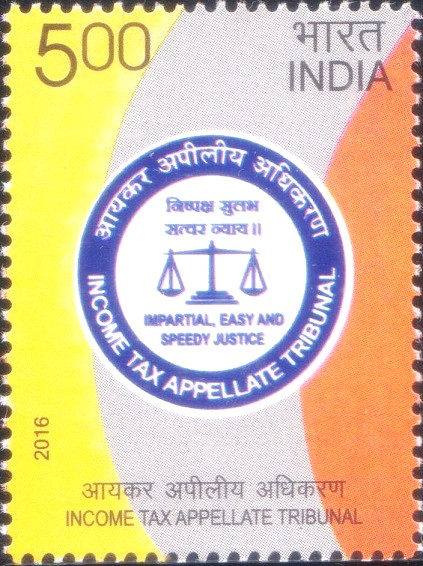

Income Tax Appellate Tribunal (ITAT)

A commemorative postage stamp on the 75th Anniversary of India‘s Income Tax Appellate Tribunal :

Issued by India

Issued by India

Issued on Jan 24, 2016

Issued for : Department of Posts is happy to issue a commemorative postage stamp on the occasion of celebration of 75th year of existence of Income Tax Appellate Tribunal.

Credits :

Stamp/FDC/Cancellation : Alka Sharma

Type : Stamp, Mint Condition

Colour : Multi Colour

Denomination : 500 Paise

Stamps Printed : 0.4 million

Printing Process : Wet Offset

Printer : Security Printing Press, Hyderabad

About :

- Income Tax Appellate Tribunal (ITAT) is a quasi judicial institution set up in January 1941 under Section 5A of the Income Tax Act, 1992 and specializes in dealing with appeals under the Direct Taxes Acts. The orders passed by the ITAT are final and an appeal lies to the High Court only if a substantial question of law arises for determination. Starting in 1941 with six Members constituting three benches – one each at Delhi, Kolkata (Calcutta) and Mumbai (Bombay), the number of Benches has progressively increased and presently ITAT has 63 Benches at 27 different stations in the country covering almost all the cities having a seat of the High Court.

- Tax was introduced in India by the Act of 1860, where assessment was made by a Panchayat and a person feeling aggrieved by the order could appeal to the Collector of the District, whose order was final. Subsequently, the successive Acts of 1868, 1869, 1870, 1872, 1886, 1916 and 1917 made improvements providing for an appeal from the order of the Collector of the District to the Commissioner of Revenue of the Division but no reference was available to the High Court under these Acts. “Income Tax Act” in its modern form was introduced which legislated advisory jurisdiction to the High Courts.

- The Act was revamped in 1922 but did not introduce any changes in the adjudicatory structure. A strong desire for establishing an independent forum for redressal of assesses aggrieved under the Income Tax Act gathered momentum especially considering that Civil Courts were prohibited from entertaining litigation in the tax matters. In November 1938 Select Committee was appointed to consider amendments to the Indian Income Tax Act, 1922 which, inter-alia, recommended establishment of a Tribunal as an independent appellate Authority for hearing appeals arising from the decision of the Appellate Assistant Commissioner. As a consequence, ITAT was constituted on January 25th, 1941 by virtue of section 5A of the Income Tax Act, 1922. Since its establishment, ITAT is functioning more or less on similar lines except for necessary consequential changes introduced on account of its expansion and extension of its jurisdiction. There have been no fundamental changes either in the constitution or the functioning of the Tribunal in the Income Tax Act, 1961.

- ITAT draws inspiration from its motto ‘Nishpaksh Sulabh Satvar Nyay‘, which means impartial, easy and speedy justice. ITAT stands out for its uniqueness of imparting justice to the litigants, by an inexpensive, easily accessible forum free from technicalities, regarded for its expert knowledge on the subject of Direct Taxes, besides rendering expeditious justice. More often than not, ITAT is referred to as ‘Mother Tribunal‘ being the oldest Tribunal in the country. Over the years, ITAT has earned accolades, as its Members have adorned high positions in the judiciary and other equally important institutions. So far, almost 32 erstwhile Members/Vice Presidents/and Presidents of ITAT have been elevated to various High Courts including two to the Supreme Court.

- Text : Based on the material received from proponent.

Subscribe

Login

0 Comments