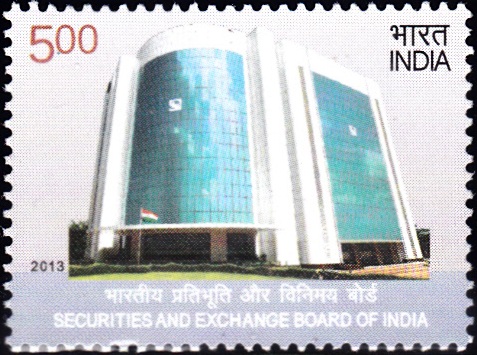

Securities and Exchange Board of India

A commemorative postage stamp on the Securities & Exchange Board of India (SEBI), the regulating body for the securities market in India :

Issued on May 24, 2013

Issued for : Department of Posts is happy to release a Commemorative Postage Stamp on completion of 25 years of successful journey of Securities and Exchange Board of India.

Credits :

Stamp/FDC/Cancellation : Alka Sharma

Type : Stamp, Mint Condition

Colour : Multi colour

Denomination : 500 Paise

Stamps Printed : 1.06 Million (0.75 million for the Proponent)

Printing Process : Wet Offset

Printer : India Security Press, Nashik

About :

- Securities and Exchange Board of India (SEBI) is the regulator of securities market in India. Securities market in India has a very fascinating & distinguished history. Towards the close of 18th century, loan securities issued by East India Company marked the beginning of dealings in securities in India. Stock trading in shares in banks and cotton mills was taking place under a Banyan Tree in Bombay during 1830s. The first formal exchange, which was later known as Bombay Stock Exchange came in existence in 1875. Subsequently, many stock exchanges were set up in different states – at Calcutta, Madras, Ahmedabad, Delhi, Hyderabad, Bangalore & Indore, being some of the important ones.

- With the increased pace of economy, the need for robust regulatory mechanism for developing healthy capital markets & for preventing trading malpractices was realised, which led to the establishment of SEBI in 1987-1988. It started functioning in 1988. SEBI was legally empowered with the passing of the SEBI Act in 1992 to function as an independent & autonomous regulator. As per the Act, SEBI’s objectives are :– to protect the interests of investors in securities market, to promote the development of securities market & to regulate the securities market. SEBI conducts surveillance through its automated Integrated Market Surveillance System (IMSS) and Data Warehousing & Business Intelligence System (DWBIS) and takes regulatory action against offenders in the securities market.

- With the passing of SEBI Act, the first decade saw substantial progress in the regulatory architecture, trading mechanism, growth & volume of the market and introduction of new class of investors like foreign portfolio investors. The second decade was more challenging with many innovative measures like further IPO reforms, corporatisation & demutualisation of stock exchanges, prudent risk management norms etc.

- Capacity building in securities market has been taken very fervently by SEBI. For this purpose, SEBI has set up a dedicated institute, namely, ‘National Institute of Securities Market‘ (NISM). It has also launched an investor awareness campaign using print & electronic media. The Indian securities market today competes with the global peers, with NSE & BSE being ranked amongst the top 10 exchanges in the world, on various parameters. SEBI is an active member of international fora such as The International Organisation of Securities Commission (IOSCO), Financial Stability Board (FSB) & Joint Forum etc. and a signatory to the Multilateral MoUs with IOSCO for information sharing & regulatory co-operation.

- Text : Based on the material furnished by the proponent.

[…] were allowed to enter the foray. The vibrancy and competition increased with the setting up of the Security Exchange Board of India, a regulatory body. The Unit Trust of India Act, 1963 was repealed in 2001. This was […]