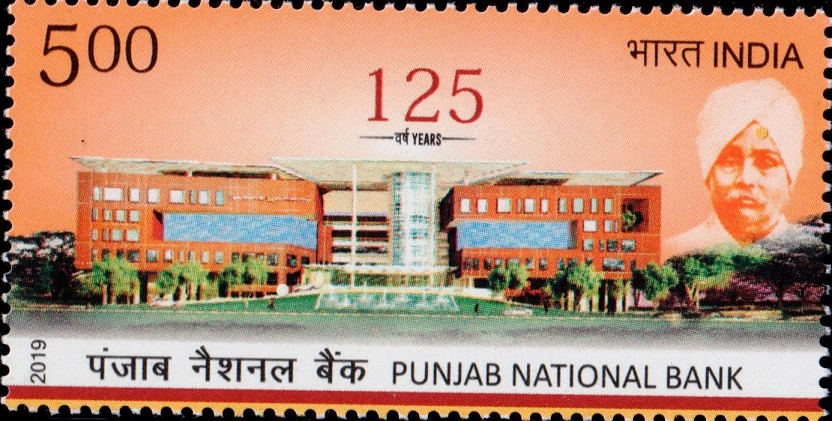

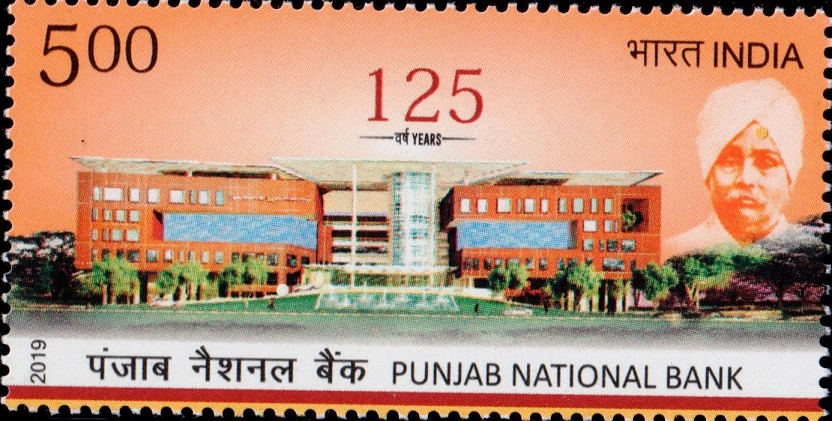

Punjab National Bank

A commemorative postage stamp on the 125th Anniversary of the Punjab National Bank (PNB) :

Issued by India

Issued by India

Issued on Apr 12, 2019

Issued for : Department of Posts is pleased to issue a Commemorative Postage Stamp on the occasion of 125th Foundation Day Celebrations of Punjab National Bank.

Credits :

Stamps/FDC/Brochure/Cancellation Cachet : Smt. Nenu Gupta

Type : Stamp, Mint Condition

Colour : Multi Colour

Denomination : 500 Paise

Stamps Printed : 605095

Printing Process : Wet Offset

Printer : Security Printing Press, Hyderabad

About :

- Punjab National Bank has traversed a long journey which commenced in 1895 solely with Indian capital indigenous enterprise. Today, PNB is amongst the premier Banks in the country with gross global business of Rs. 11.26 lakh Cr. serving more than 100 million customers as at the end of December 2018. The Bank has a pan India presence and has the largest network of branches amongst nationalized banks with more than 7000 branches.

- The history of PNB is intertwined with the history of our country. Fired by the spirit of nationalism and founded on the idea that Indians should have national bank of their own, PNB Ltd was the result of the efforts of far-sighted visionaries and patriots, among whom were luminaries like Lala Lajpat Rai, Mr. E C Jessawala, Babu Kali Prasono Roy, Lala Harkishan Lal and Sardar Dyal Singh Majithia. Incorporated under the Act VI of 1882, Indian Companies Act, the Bank commenced operations on April 12, 1895 from Lahore with an authorized total capital of Rs. 2 lac.

- During this eventful journey, the Bank withstood various financial crises including widespread Bank failures in 1913, the Great Depression, the two World Wars and the trauma of partition in 1947 when the Bank had to close 92 offices (33%) in West Pakistan holding 40% of its deposits and lost 15 of its staff who fell victims to the communal frenzy. Taking all these turmoils and tribulations in its stride, the Bank continued its relentless march to newer milestones successfully navigating through periods of extreme challenges. Subsequently, the Bank registered impressive performance and grew from strength to strength over the years.

- The success was also an outcome of the pioneering initiatives taken by the Bank. The founding fathers and the successors thought ahead of time and were true visionaries with the foresight to consider issues of quality, autonomy, delegation, discipline, directors’ role, customer service, frauds, bad debts, cost control, staff welfare, public interest, management requirement scheme, outside audit, etc. 120 years ago, decades before they became mandatory. As a result PNB’s history is a “History of Firsts” – first to take measures and initiatives in Audit, Training, Teller System, CBS, People Development, Digitalization, War room for NPA Management, Risk Management etc.

- The Nationalization of Banks in 1969 unleashed a new chapter in the long history of the Bank. Keeping with the economic ideology of catalysing development and amelioration of poverty by funding various self-employment schemes, PNB expanded its presence rapidly in unbanked areas. The Bank donned the role of a facilitator in providing the vital input of credit and consistently exceeded the national goals in respect of priority sector lending.

- PNB has thus established itself firmly as one of the premier banking institutions in the country with a long tradition of sound and prudent banking. There has been take-over/merger of 7 banks during different periods in Bank’s history. The first ever merger of a nationalized bank in the banking industry was in 1993, when New Bank of India was merged with PNB.

- The Bank provides a bouquet of financial services to various customer segments which include Salaried class, students, Self Employed, Farmers, Professionals, Traders, Corporates, Women, MSMEs etc. Besides providing the traditional banking products, the Bank also serves the Non Banking financial needs of its customers like Mutual Funds, Life and Non Life Insurance, Door Step banking Cash Management Depository services, ASBA, Online Trading services, various tax collection, pension disbursement, PPF accounts etc. The Bank also has a wide array digital products for providing customer ease and operational efficiency such as Internet Banking, Mobile Banking, SMS Alerts etc. The Bank is also providing various services through Apps such as PNB One, PNB m-Pass Book, BHIM, UPI PNB Genie, PNB m-Banking, PNB Mobi-Ease, ATM Assist.

- At PNB, Corporate Social Responsibility (CSR) has always been an integral part of the business strategy of growing responsibility by deepening relationships and engagement with all the stakeholders’ viz. employees, customers, shareholders and the society as a whole. The Bank values its role as one of the leading domestic banks in supporting local and national efforts for making lives better. The Bank has clearly delineated CSR agenda and initiatives have been taken across a broad front including economic, social, health, promotion of sports, training, environmental protection etc. Under the aegis of the PNB Farmers’ Welfare Trust, 12 “Farmers Training Centres” (FTCs) located in rural areas provide free of cost training on agriculture & allied activities. Besides, the Bank has 55 Rural Self Employment Training Institute (RSETIs) and 2 Rural Development Centres that are focusing on training and economic upliftment of participants by ensuring adequate credit for inclusive growth.

- The Bank’s performance over the years has resulted in the awards and accolades being won by the Bank at various prestigious platforms. In view of its excellent performance, the Bank was awarded Dun & Bradstreet Banking Awards 2017 – Best Public Sector Bank – Government Scheme participation – Pradhan Mantri Mudra Yojana (PMMY). In recognition of adopting new and innovative processes in banking operations, PNB was awarded Special Award for excellent performance in Rupay, NFS ATM Network, CTS, UPI/IMPS & NACH in National Payments Excellence Awards 2017. Further, under PMJDY, PNB was ranked first among all banks by Government of India in deposit mobilization and second in its overall implementation. The Bank has also been ranked as the 2nd Best Public Sector Bank in terms of Total Aadhar Generation and Updates.

- Recently, the BCG-IBA launched “EASE Reforms Index and EASE Report” which measured the performance of each PSB on 140 objective metrics across 6 themes. PNB was adjudged the Best Performing Public Sector Bank and was conferred with “EASE Reforms Excellency” award 2018, ranking first in the EASE (Enhanced Access & Service Excellence) index. PNB was also declared the best PSB under the themes of Customer Responsiveness, Responsible Banking and Credit off-take and Runner Up Bank under the theme Deepening Financial Inclusion & Digitalization.

- Going forward, the Bank aims to maintain its position as the premier National Bank of the country by focusing on providing superior banking experience to its customers through continuous innovation and improvement in systems, processes, products and services. The Bank remains committed to maintain the highest levels of ethical standards, professional integrity, corporate governance and regulatory compliance for realisation of its grand vision.

- Text : Based on information received from the proponent.

Subscribe

Login

0 Comments